colorado springs sales tax calculator

All numbers are rounded in the normal fashion. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax.

Sales Tax Information Colorado Springs

To calculate the sales tax amount for all other values use our sales tax calculator above.

. How to use Colorado Springs Sales Tax Calculator. 307 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. 290 Colorado State Sales Tax 420 Maximum Local Sales Tax 710 Maximum Possible Sales Tax 744 Average Local State Sales Tax.

80901 80902 80903. Sales Tax Breakdown Colorado Springs Details Colorado Springs CO is in El Paso County. Colorado Sales Tax Calculator You can use our Colorado Sales Tax Calculator to look up sales tax rates in Colorado by address zip code.

What is the sales tax rate in Colorado Springs Colorado. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 29. Manitou Springs is located within El Paso County Colorado.

The December 2020 total local sales tax rate was 8250. The average cumulative sales tax rate in Manitou Springs Colorado is 903. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Colorado QuickFacts.

Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Colorado Springs sales tax in 2021. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

View Local Sales Tax Rates. City sales tax collected within this date range will report at 312. Find both under Additional Services View Sales Rates and Taxes.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. Visit the COVID-19 Sales Tax Relief web page for more information and filing instructions. Sales tax in Colorado Springs Colorado is currently 825.

If your business purchased or consumed items with an invoice date of 12312020 and prior the use tax will be due at the previous tax rate of 312. Download state rate tables. Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following.

Within Manitou Springs there is 1 zip code with the most populous zip code being 80829. The sales tax rate does not vary based on zip. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Colorado Springs CO Sales Tax Rate The current total local sales tax rate in Colorado Springs CO is 8200. This is because many cities and counties have their own sales taxes in addition to the. Multiply the vehicle price after trade-ins but before incentives by the sales tax fee.

Historical Sales Tax Rates for Colorado Springs 2022 2021 2020. This includes the rates on the state county city and special levels. The Colorado sales tax rate is currently.

How to Calculate Colorado Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. Sales Tax Rates in Revenue Online.

The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. The combined rate used in this calculator 82 is the result of the colorado state rate 29 the 80909s county rate 123 the colorado springs tax rate 307 and in some case special rate 1. Instructions for City of Colorado Springs Sales andor Use Tax Return 312 Sales and Use Tax Return.

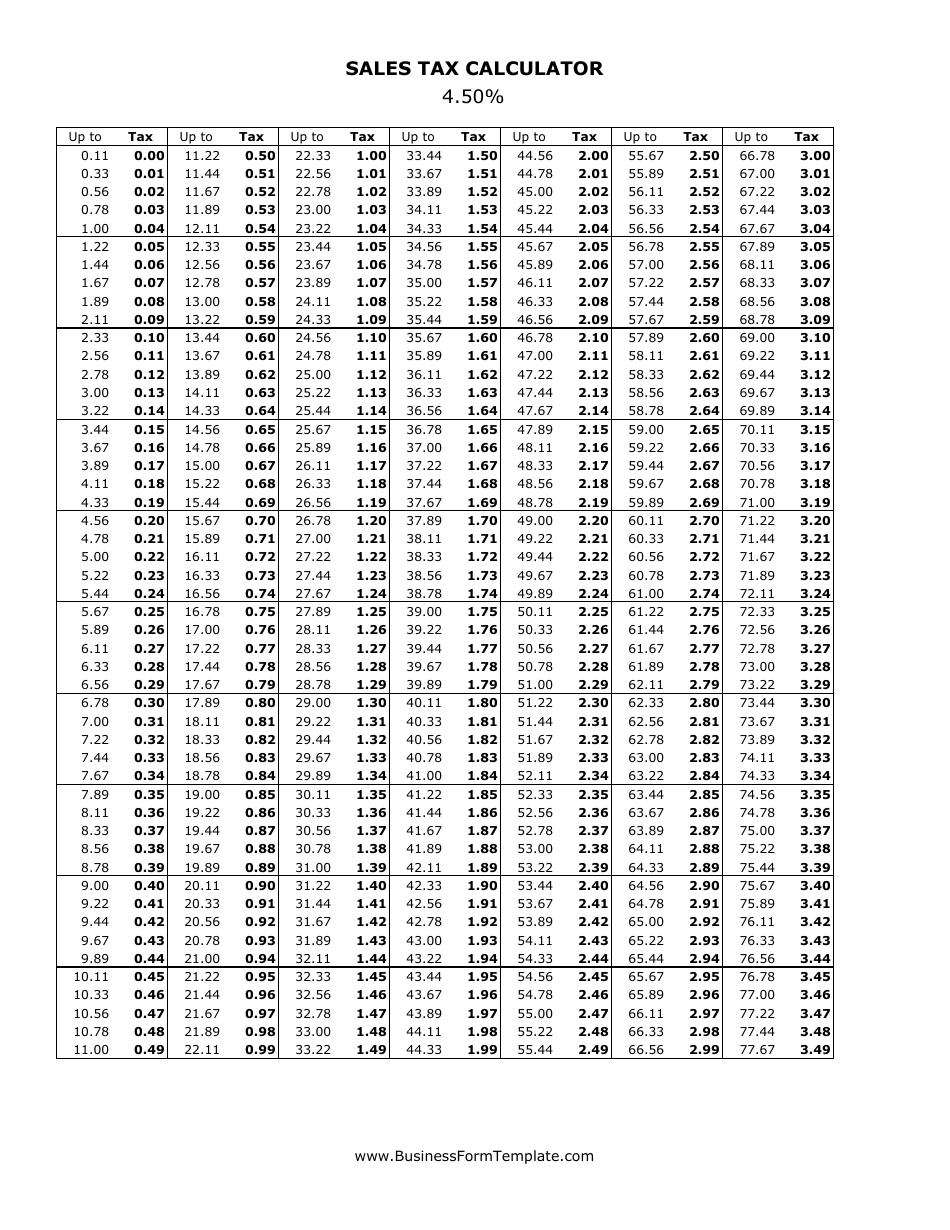

The County sales tax rate is. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 724 in Colorado Springs Colorado.

The sales tax rate for Colorado Springs was updated for the 2020 tax year this is the current sales tax rate we are using in the Colorado Springs Colorado Sales Tax Comparison Calculator for 202223. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. The Colorado Springs sales tax rate is.

Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list. The average sales tax rate in Colorado is 6078. You can print a 82 sales tax table here.

We are proud to serve the great people of Colorado as efficiently and safely as possible. All Zip Codes in Colorado Springs Colorado 80901 80902 80903 80904. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The combined amount is 820 broken out as follows. View Business Location Rates. Licensed retailers can find rate and jurisdiction code information for.

Colorado state sales tax rate range 29-112 Base state sales tax rate 29 Local rate range 0-83 Total rate range 29-112 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. The minimum is 29. For tax rates in other cities see Colorado sales taxes by city and county.

This is the total of state county and city sales tax rates. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. The last rates update has been made on July.

Rates are expressed in mills which are equal to 1 for every 1000 of property value. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. S Colorado State Sales Tax Rate 29 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Colorado Springs Sales Tax Calculator or compare Sales Tax between different locations within Colorado using the Colorado State Sales Tax Comparison Calculator.

Colorado Springs was founded 150 years ago on July 31 1871. Method to calculate El Paso County sales tax in 2021. Sales Tax State Local Sales Tax on Food.

Colorado Springs is in the following zip codes. Did South Dakota v. Real property tax on median home.

Two services are available in Revenue Online. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Background - Understand the importance of properly completing the DR 0024 form.

However as anyone who has spent time in Denver Boulder or Colorado Springs can tell you actual sales tax rates are much higher in most cities. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Colorado Sales Tax.

This service provides tax rates for all Colorado cities and counties.

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Bankerbhai Expense Inflation Calculator Investment Finance Homeloan Loan Personalloan Fridayfeeling Exitpol Business Tax Financial Planning Tax Prep

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

California Sales Tax Calculator Reverse Sales Dremployee

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Income Tax Preparation

Colorado Springs Sales Tax Revenues Zoom To Record High In January Business Gazette Com

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Calculate Sales Tax Definition Formula Example

Colorado Springs Sales Tax Revenues Zoom To Record High In January Business Gazette Com